![]() As the Revolutionary War was nearing its end, two situations existed which acted as threats against the well-being of the Patriot Cause for Pennsylvania: 1.) Money was needed to continue the financing of the war effort, and 2.) More recruits were needed for the Continental Army and the Militia.

As the Revolutionary War was nearing its end, two situations existed which acted as threats against the well-being of the Patriot Cause for Pennsylvania: 1.) Money was needed to continue the financing of the war effort, and 2.) More recruits were needed for the Continental Army and the Militia.

![]() Although the surrender of General Cornwallis in October of 1781 signalled the defeat of that British Army in America, there was no real assurance that the war was over. A slight majority of the members of the House of Commons wanted King George III to end the war in America. The theatres of war in India and the West Indies were demanding more and more of the British Army's resources. In February of 1782 a motion was made before the House by General Conway "against any further prosecution of the American War..." This motion was presented to the King in March, and he in turn responded in a round-about way by declaring that there were no objects dearer to his heart than the ease and happiness, and prosperity of his people. Such an answer did not fully satisfy the House, and debate over the issue continued for a couple more months. It was not until the 5th if May, 1782 that Sir Guy Carleton arrived in New York (having been appointed to command the British troops in America in the place of Sir Henry Clinton) with the message for General George Washington that the British Parliament had recently set the wheels of peace negotiation in motion. Carleton requested that a passport be issued for another British agent, Mr. Morgan, that he might carry a similar letter of peaceful intent to the American Congress, but this request was refused by the Congress on the grounds that the American government would not enter into any peace negotiations apart from its ally, France. The Americans feared that this might simply be a trick to disunite them.

Although the surrender of General Cornwallis in October of 1781 signalled the defeat of that British Army in America, there was no real assurance that the war was over. A slight majority of the members of the House of Commons wanted King George III to end the war in America. The theatres of war in India and the West Indies were demanding more and more of the British Army's resources. In February of 1782 a motion was made before the House by General Conway "against any further prosecution of the American War..." This motion was presented to the King in March, and he in turn responded in a round-about way by declaring that there were no objects dearer to his heart than the ease and happiness, and prosperity of his people. Such an answer did not fully satisfy the House, and debate over the issue continued for a couple more months. It was not until the 5th if May, 1782 that Sir Guy Carleton arrived in New York (having been appointed to command the British troops in America in the place of Sir Henry Clinton) with the message for General George Washington that the British Parliament had recently set the wheels of peace negotiation in motion. Carleton requested that a passport be issued for another British agent, Mr. Morgan, that he might carry a similar letter of peaceful intent to the American Congress, but this request was refused by the Congress on the grounds that the American government would not enter into any peace negotiations apart from its ally, France. The Americans feared that this might simply be a trick to disunite them.

![]() In Paris, on the 30th of November, 1782 provisional articles of peace were signed which acknowledged "the united colonies of New Hampshire, Massachusets Bay, Rhode Island and Providence Plantations, Connecticut, New York, New Jersey, Pennsylvania, Delaware, Maryland, Virginia, North Carolina, South Carolina and Georgia to be free, sovereign and independent states."

In Paris, on the 30th of November, 1782 provisional articles of peace were signed which acknowledged "the united colonies of New Hampshire, Massachusets Bay, Rhode Island and Providence Plantations, Connecticut, New York, New Jersey, Pennsylvania, Delaware, Maryland, Virginia, North Carolina, South Carolina and Georgia to be free, sovereign and independent states."

![]() It should be noted, though, that the naval theatre of war in the Carribean was still being engaged while the peace negotiations were underway in Paris. one of the original, underlying causes of the American Revolutionary War was the importation duties and restrictions set by the government of Great Britain on sugar from the West Indies. Because of British government would not allow the direct importation of sugar from the West indies into the American colonies (demanding that all such traffic be routed first to ports in the British Isles and then back to the Amercian ports), the duties that the American people had to pay for this precious commodity were ridiculously high. The Americans were, understandibly, unsure of the effectiveness of the peace negotiations, and would not be totally sure until the fighting, even in the Carribean, ceased. As this American Revolutionary War had developed into an international war, the negotiations for peace were complex, and were not completely resolved overnight.

It should be noted, though, that the naval theatre of war in the Carribean was still being engaged while the peace negotiations were underway in Paris. one of the original, underlying causes of the American Revolutionary War was the importation duties and restrictions set by the government of Great Britain on sugar from the West Indies. Because of British government would not allow the direct importation of sugar from the West indies into the American colonies (demanding that all such traffic be routed first to ports in the British Isles and then back to the Amercian ports), the duties that the American people had to pay for this precious commodity were ridiculously high. The Americans were, understandibly, unsure of the effectiveness of the peace negotiations, and would not be totally sure until the fighting, even in the Carribean, ceased. As this American Revolutionary War had developed into an international war, the negotiations for peace were complex, and were not completely resolved overnight.

![]() The situation that Pennsylvania, and the other newly declared states found themselves in as the year 1782 began was one of unsurety. And because of the unsurety of peace, steps had to be taken to ensure that the Patriot Cause did not falter. As previously noted, two problem situations existed as 1782 dawned: the need for more money to finance the war, and the need for more troops because the ones already in service had had enough after some six or seven years. The remedy for both problems was determined to be the application of a tax. It was called the Class Tax because all the residents of the various counties were divided up into numbered groups (i.e. classes). The classes were composed of roughly equal division of the inhabitants of each township area; some were large, some were small. The collection of this tax would increase the amount in the treasury. It would also aid in determining who was loyal to the Patriot Cause, and/or who was against it. This latter point being an assumption that all loyal Patriots would dutifully pay their assigned taxes, whereas Tories and Loyalists would refuse to do so.

The situation that Pennsylvania, and the other newly declared states found themselves in as the year 1782 began was one of unsurety. And because of the unsurety of peace, steps had to be taken to ensure that the Patriot Cause did not falter. As previously noted, two problem situations existed as 1782 dawned: the need for more money to finance the war, and the need for more troops because the ones already in service had had enough after some six or seven years. The remedy for both problems was determined to be the application of a tax. It was called the Class Tax because all the residents of the various counties were divided up into numbered groups (i.e. classes). The classes were composed of roughly equal division of the inhabitants of each township area; some were large, some were small. The collection of this tax would increase the amount in the treasury. It would also aid in determining who was loyal to the Patriot Cause, and/or who was against it. This latter point being an assumption that all loyal Patriots would dutifully pay their assigned taxes, whereas Tories and Loyalists would refuse to do so.

![]() In the early part of 1782 the Bedford County Commissioners sent the following directive to the Tax Collectors of the various townships:

In the early part of 1782 the Bedford County Commissioners sent the following directive to the Tax Collectors of the various townships:

"You are hereby required forthwith to collect and receive from the persons assessed the several sums in this your Duplicate respectively mentioned and shall in six - Weeks at least render a just and true account of and take in and pay unto us at Bedford of such sums of Money as you shall have received, and pay the whole and every of the sums of Money assessed in this your Duplicate within two Months after this Date. - But in Case any Person or Persons so rated or Assessed shall neglect or refuse to pay the Sum or Sums so assessed by the Space of thirty Days after Demand made, then in such case you are forthwith to return the Name or Names of such Person or Persons so neglecting or refusing to us at Bedford in order that a Special Warrant may be issued against the said Person or Persons so refusing or neglecting agreeably to the Law in such Case made and provided - And herein you are not to fail under such Penalties as the Law Directs."

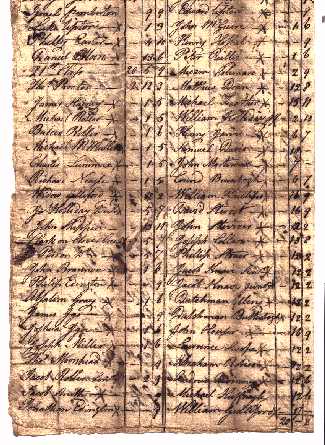

![]() The Class Tax of 1782 was important because all able-bodied men (i.e. between the ages of 18 and 53 years) were supposed to be accounted for to pay the tax. The returns for Bedford County are stored in the Vault #1 of the Bedford County Court House. Not all township returns are extant in this collection, but the ones which do exist show a high percentage of compliance with the tax.

The Class Tax of 1782 was important because all able-bodied men (i.e. between the ages of 18 and 53 years) were supposed to be accounted for to pay the tax. The returns for Bedford County are stored in the Vault #1 of the Bedford County Court House. Not all township returns are extant in this collection, but the ones which do exist show a high percentage of compliance with the tax.

![]() The returns generally listed the "delinquent" residents. In other words, the tax collector would have the listing of his township's residents, which he normally would use (such as the one taken just the previous year), and might only make a new listing of the residents from whom he could not readily collect the tax - the delinquent ones. Many of the returns, though, were complete lists of the township residents. beside whose names the tac collector would put a check mark as they were paid. The amount of tax an individual would be required to pay was based on the valuation of his property. The returns for this Class Tax generally show only the amount of the tax, and not the property valuation; the amounts were given in pounds, shillings and pence.

The returns generally listed the "delinquent" residents. In other words, the tax collector would have the listing of his township's residents, which he normally would use (such as the one taken just the previous year), and might only make a new listing of the residents from whom he could not readily collect the tax - the delinquent ones. Many of the returns, though, were complete lists of the township residents. beside whose names the tac collector would put a check mark as they were paid. The amount of tax an individual would be required to pay was based on the valuation of his property. The returns for this Class Tax generally show only the amount of the tax, and not the property valuation; the amounts were given in pounds, shillings and pence.

![]() One last thing should be mentioned in regard to this Class Tax. The various classes within each township region were expected to supply not only their share of the revenue to finance the war effort, but also recruits for the militia or standing army (the Continental Line). Persons who refused to pay their assessed tax would be fined, and failure to pay that fine could result in a more severe fine or a court action against the individual. The township class in which an individual refused to pay would be expected to compensate for that individual's failure to comply. The form that this compensation took might be either forced payment of that individual's tax from the ranks of the rest of the class, or the recruitment of one of the able-bodied men into the militia or standing army for a period of 18 months. The threat of such action was intended (and often succeeded) as motivation for the residents of the township class to exert peer pressure on each other.

One last thing should be mentioned in regard to this Class Tax. The various classes within each township region were expected to supply not only their share of the revenue to finance the war effort, but also recruits for the militia or standing army (the Continental Line). Persons who refused to pay their assessed tax would be fined, and failure to pay that fine could result in a more severe fine or a court action against the individual. The township class in which an individual refused to pay would be expected to compensate for that individual's failure to comply. The form that this compensation took might be either forced payment of that individual's tax from the ranks of the rest of the class, or the recruitment of one of the able-bodied men into the militia or standing army for a period of 18 months. The threat of such action was intended (and often succeeded) as motivation for the residents of the township class to exert peer pressure on each other.

![]() For Bedford County, returns of the 1782 Class Tax for the following classes are extant and kept with the tax assessment records in Vault #1 of the Bedford County Court House.

For Bedford County, returns of the 1782 Class Tax for the following classes are extant and kept with the tax assessment records in Vault #1 of the Bedford County Court House.

Bedford Twp: (the central portion of present-day Bedford County) Classes 55 through 61

Brothers Valley Twp: (the eastern portion of present-day Somerset County) Classes 34 through 39

Colerain Twp: (the western portion of present-day Fulton County) Class 48

Cumberland Valley Twp: (the eastern portion of present-day Bedford County) Class 50

Frankstown Twp: (present-day Blair County) Classes 11 through 21

Shirley Twp: (the eastern portion of present-day Huntingdon County) Classes 43 through 49, and 59

Quemahoning Twp: (the most of present-day Cambria County) Classes 40 through 42

Frankstown Twp - Showing the 21st Class which includes the name of Jacob Schmitt, Sr (aka Jacob Smith, second entry from bottom on left column), an ancestor of this site's owner, Larry Smith.